Islamabad’s real estate market in 2025 is not just about buying and selling — it’s about generating consistent rental income. With more professionals, students, and overseas Pakistanis seeking quality housing, rental yields have become a key performance metric for smart investors.

In this post, we break down the top-performing sectors in Islamabad that offer the best rental yields in 2025, backed by data, development trends, and demand drivers.

💼 What Is Rental Yield & Why Does It Matter?

Rental yield is the annual rental income divided by the property’s value, expressed as a percentage. It’s a great indicator for:

- Evaluating investment potential

- Comparing areas for ROI

- Deciding between residential and commercial properties

In Islamabad, a 5–7% rental yield is considered healthy. Let’s explore which areas are crossing this threshold in 2025.

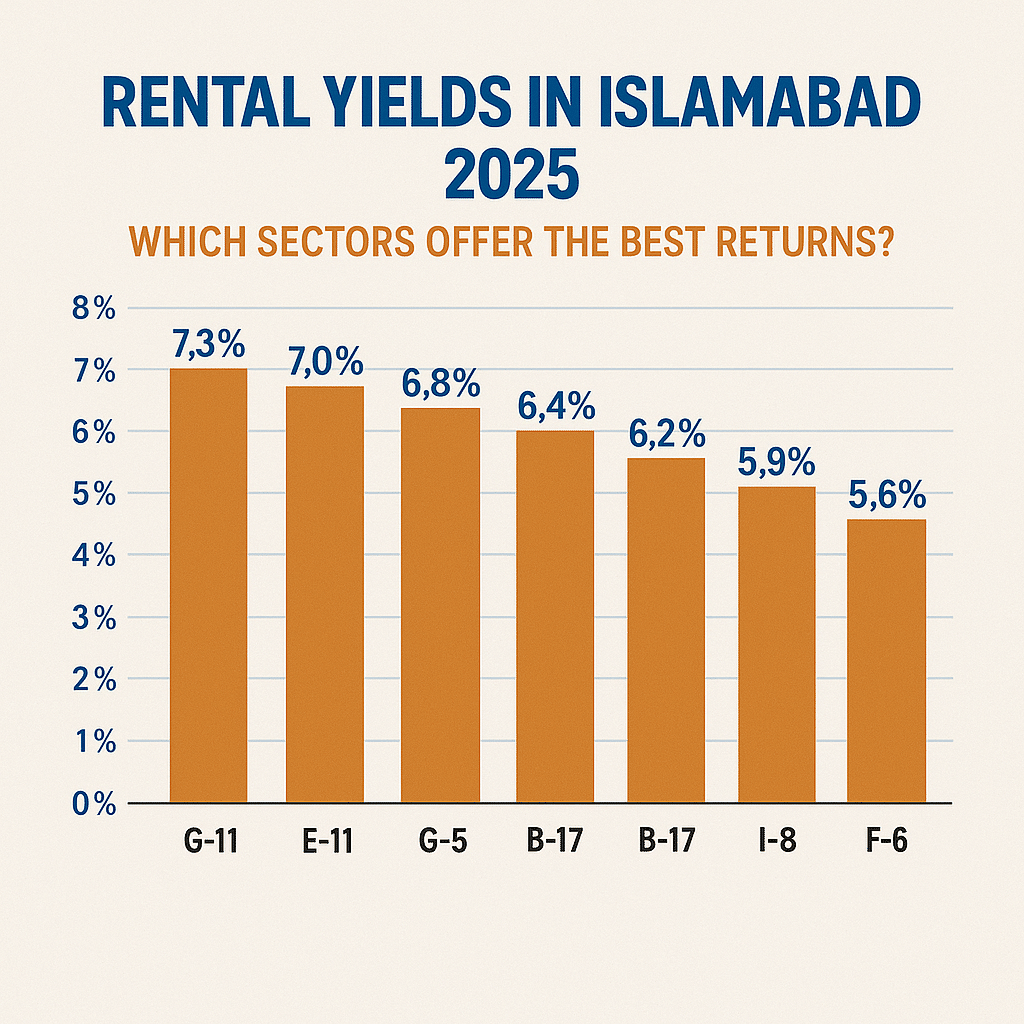

🏡 Top Sectors with High Rental Yields in Islamabad 2025

🏙️ 1. B-17 Multi Gardens

- Average Rental Yield: 6.5% – 7.2%

- Why It Stands Out:

- Affordable apartment prices

- Rising demand due to population shift

- Popular projects like Valencia Heights attract both families and students

Tip: 2-bedroom apartments in Valencia Heights B-17 under PKR 1.5 crore are generating high ROI with consistent occupancy.

🏙️ 2. G-13 and G-14

- Average Rental Yield: 5.8% – 6.4%

- Why It Stands Out:

- Strong demand from government employees

- Close to Kashmir Highway & Metro Bus Route

- Limited inventory keeps rents stable

🏙️ 3. DHA Islamabad (Phase 2 & Phase 5)

- Average Rental Yield: 5.5% – 6.2%

- Why It Stands Out:

- Popular among professionals & expats

- High-quality apartments and security

- Good amenities with gated community living

🏙️ 4. Gulberg Greens & Gulberg Residencia

- Average Rental Yield: 5.0% – 6.0%

- Why It Stands Out:

- Rapid commercial development

- Increasing apartment projects

- Corporate tenants are boosting rental values

🏙️ 5. E-11 Sector

- Average Rental Yield: 5.5% – 6.5%

- Why It Stands Out:

- Mix of high-rise and low-rise rentals

- Close to major hospitals, markets, and schools

- Preferred by upper-middle-class tenants

📊 Rental Yield Comparison Table

| Sector | Rental Yield (2025) | Property Type | Price Range |

|---|---|---|---|

| B-17 Multi Gardens | 6.5% – 7.2% | Apartments & Plots | PKR 65 – 150 lakh |

| G-13 / G-14 | 5.8% – 6.4% | Houses & Flats | PKR 120 – 300 lakh |

| DHA Ph 2/5 | 5.5% – 6.2% | Flats & Villas | PKR 150 – 400 lakh |

| Gulberg Greens | 5.0% – 6.0% | Apartments & Plots | PKR 100 – 200 lakh |

| E-11 | 5.5% – 6.5% | Luxury Apartments | PKR 120 – 350 lakh |

🔍 What Drives Rental Demand in Islamabad?

- Migration to capital from smaller cities

- Job growth in IT, government, and corporate sectors

- Increased demand for furnished apartments by expats

- Limited new apartment inventory in central sectors

💡 Tips for Maximizing Rental Yields in 2025

- Choose ready-to-rent apartments in high-demand sectors

- Offer semi-furnished or fully furnished options

- Target working professionals and students

- Invest in projects with maintenance and security services

- Consider emerging vertical projects like Valencia Heights B-17

✅ Final Thoughts

In 2025, Islamabad offers multiple rental-friendly sectors, but B-17 Multi Gardens, G-13, and DHA are clear leaders in terms of ROI. For those on a mid-range budget, apartments under PKR 1.5 crore in B-17 are delivering exceptional yields.

If your goal is monthly income with property appreciation, now’s the time to act.